owners draw report in quickbooks online

So if you are a sole proprietor a partner or an LLC you can go for the owners draw. Looking for a Microsoft Word course for beginners to experts.

Quickbooks Online Tutorial Clean Up Last Year S Erroneous Balance Sheet Advanced Webinar Youtube

7 Ways to Use Your Online Reputation to Get More Traffic Leads and Sales Free Webinar on April 12th 4 comments.

. How I Neil Patel do my Keyword Research. Please enter an account name and description for an Owners Draw. Online tax tables unless the company subscribes to a QuickBooks payroll service.

For example minimal review of calculations based on a payroll report by a. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. Get 247 customer support help when you place a homework help service order with us.

Apply pre-designed Styles and format text with fonts and colors. To apply for forgiveness for your second draw loan you must have completed the forgiveness process for your first draw loan. Look for opportunities to create a cross-promotional deal with them so that you can tap each others client bases and advertise for free.

Reach out to other small business owners who are marketing goods and services that complement yours. Create save and share documents. These small business owners thus do not receive W-2 forms.

They can use the money in the business to pay personal expenses without adverse tax consequences. Join professional groups and business organizations in your area. The Ultimate Guide for Creating Compelling Copy.

At 10399 per year Quicken Home and Business is less than half the cost of QuickBooks Onlines entry-level plan. Place your Adjusted Gross Income AGI from Form 1040 on Line 2. 4 Tips for Getting Better Data Out of Ubersuggest.

Protect Your Personal Assets by Forming the Business as a Corporation or LLC. Work with bullets indents and line spacing. The owners draw is the distribution of funds from your equity account.

The more affordable price tag is. Also you cannot deduct the owners draw as a business expense unlike salary. Enter your Equity investment.

All of the choices are correct. Never start a business as a sole proprietorship which can result in. This leads to a reduction in your total share in the business.

Go to the bottom left of this page to find the Account tab. This online course has something for everyone covering beginner intermediate and advanced lessons in Word. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Open the chart of accounts use run report on that account from the drop down arrow far right of the account name. Opening Balance Equity c. Sole proprietors of businesses are not eligible to receive salaries as it is prohibited by law.

Cash - Operating d. To fill out the forms correctly to receive the tax breaks from the Self-Employed Health Insurance Deductions you need to fill out Schedule A to report your medical expenses you paid for during the tax year only the year of the tax cycle are permitted onto Line 1 of the form. For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a.

The Perfect Landing Page Blueprint. SunTrust Bank offers online account services to personal business and wealth management customersFor both personal and business accounts users can log in by going to the banks personal or business homepage selecting between Online Banking and Online. Loans and SBA Form 2483-SD or SBA Form 2483-SD-C for Second Draw PPP Loans.

Lenders are expected to perform a good faith review in a reasonable time of the borrowers calculations and supporting documents concerning average monthly payroll cost. You can also use the keyboard shortcut CTRL A to set the chart of accounts. Not allowed to deduct personal expenses paid against business income.

QuickBooks does not use a. How Do I Book An OwnerS Distribution In Quickbooks. The report displays a proper representation of the income and expenses of the company.

With hefty late-payment fees that your lender will report to the credit bureaus making your credit even. Many payroll providers have designed a report catered specifically to the PPP Forgiveness Application process and the SBA will accept this report in lieu of bank statements tax forms or period payroll reports.

Double Entry Accounting Has Come To Freshbooks Small Business Accounting Accounting Double Entry

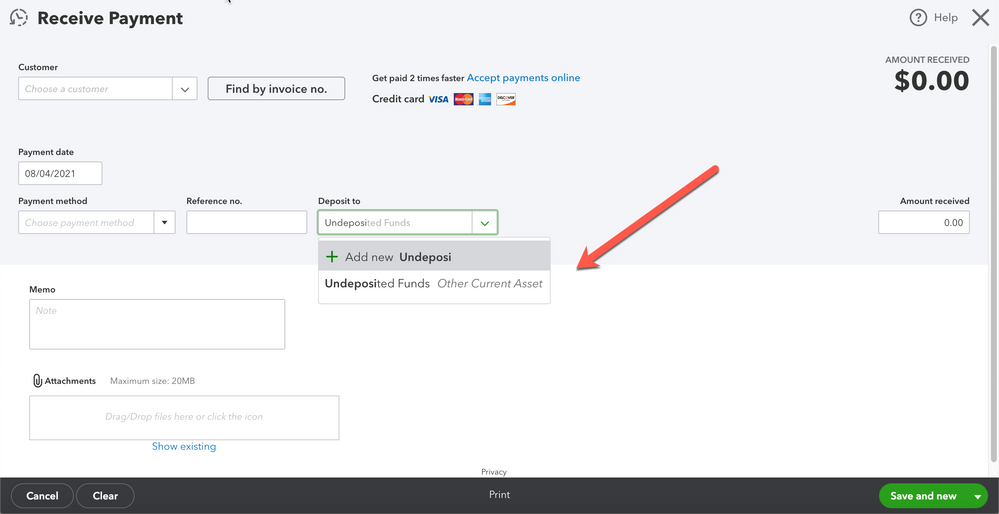

Using Undeposited Funds In Quickbooks Online

Quickbooks Owner Draws Contributions Youtube

I Need Help With Owners Equity Entry

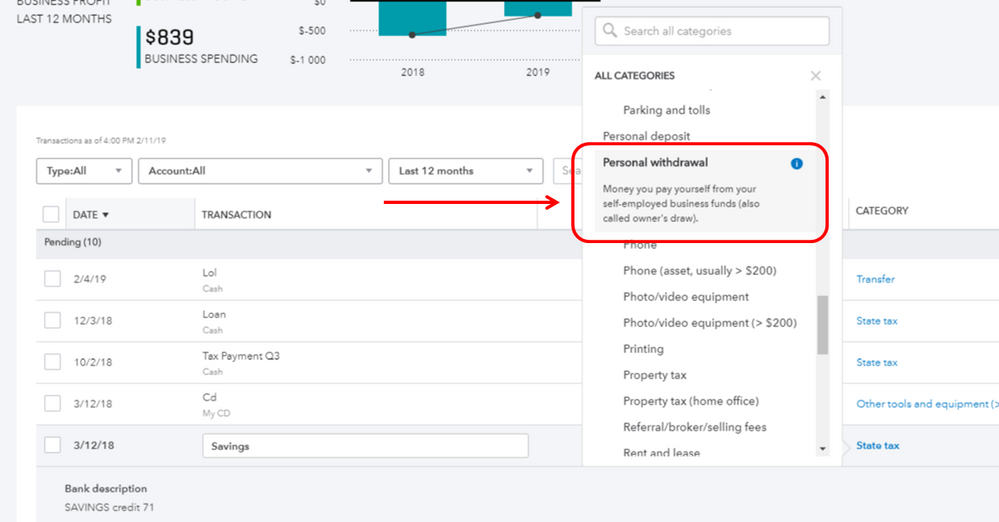

Quickbooks Online Tutorial Categorizing Dowloaded Transactions 2019 Youtube

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

Onpay Payroll Services Review Payroll Software Payroll Advertising Methods

Connect And Review Your Banking In Quickbooks Onli

How To Pay Invoices Using Owner S Draw

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

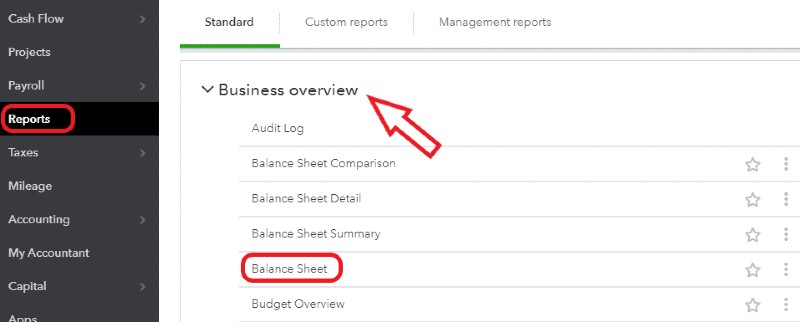

How To Create A Balance Sheet In Quickbooks Online

How To Create A Balance Sheet In Quickbooks Online

Setup And Pay Owner S Draw In Quickbooks Online Desktop

How To Record Owner Investment In Quickbooks Updated Steps

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Think Of The Undeposited Funds Account As An Envelope Where You Keep Checks The First Time You Receive Payments Use A Payment Quickbooks Fund Accounting Fund